Indiana Department of Revenue Releases New Online Filing & Payment Portal

Published:On September 3, 2019, for certain entities and filing types currently registered to file/pay tax online, the Indiana Department of Revenue (IDR) will release their new online e-services portal called INTIME. The new portal will only be available for the following: C Corporations, S Corporations, Partnerships, Utility Receipts, Financial Institutions, Nonprofits, and Aircraft customers. Other entities and tax types will be added in the future.

Below is an article issued by IDR on the registration process, access to a downloadable start guide, and information on the new power of attorney process.

Additional highlights:

- All of the current online applications will be unavailable on Saturday, August 31 from 7 am to 7 pm EST. This includes INtax, INtax Pay, INBiz, and DORpay.

- INTIME will go live on Tuesday, September 3rd, at 10 am EST. See this link for tax filings and payments affected by the new portal

- You will not be able to register for your new INTIME account until it goes live.

- In the video of the article, IDR indicates that to register you will need either a letter from IDR or one of the last 5 payment amounts paid to IDR. If you do not have either, the website will allow you to click on a link to request a letter from IDR.

- Because some payments will be due in September, if this change is applicable to you, we encourage you to start the registration process shortly after the website is live.

If you have any questions, please contact us at 317-241-2999.

Full article with video found at: Indiana Department of Revenue

|

|||

Important INTIME Information |

|||

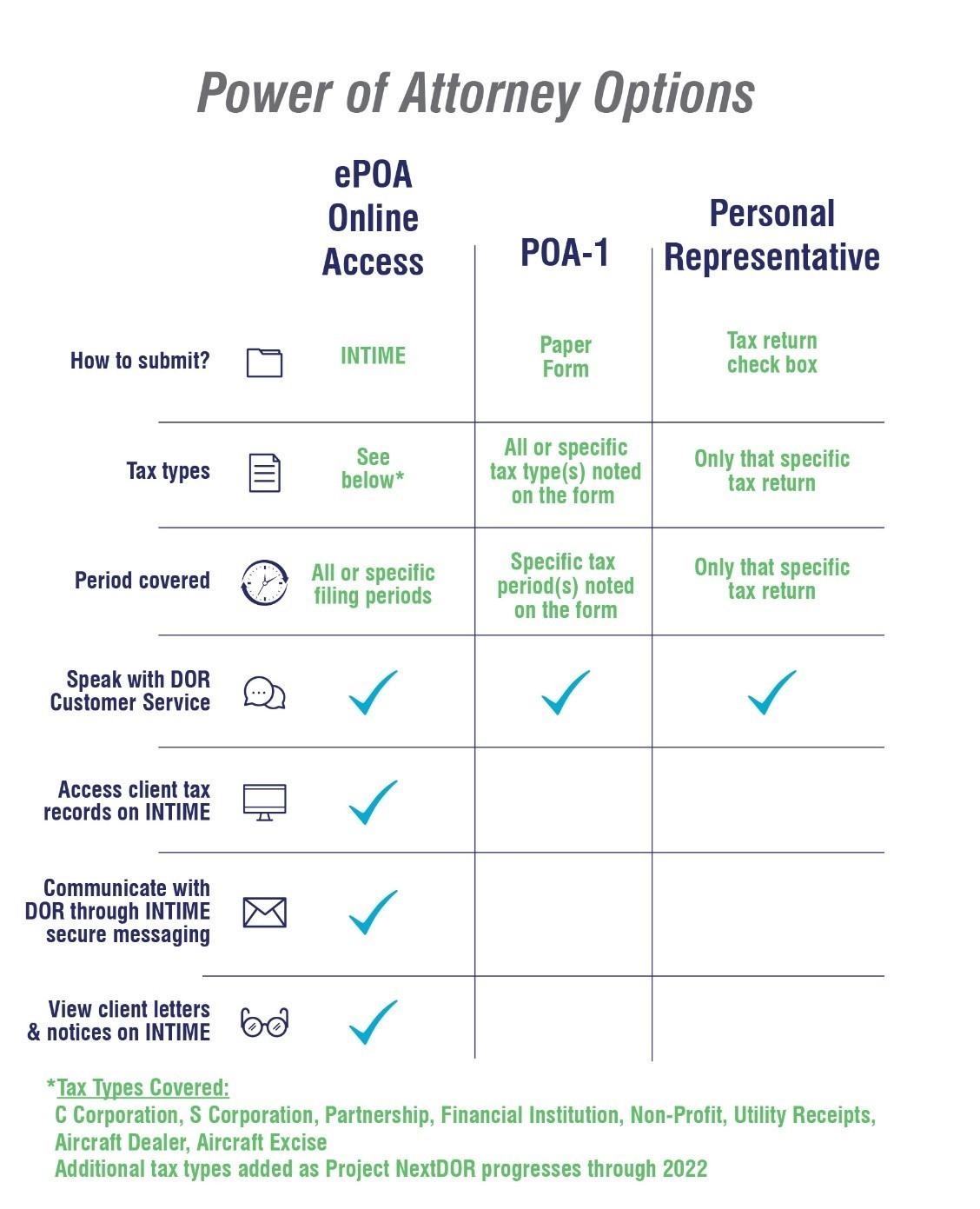

Over the last two weeks, the Indiana Department of Revenue (DOR) has introduced Hoosiers to Project NextDOR and INTIME—the agency’s four year modernization project and online portal. In Part 3 of 4, DOR demonstrates how specific users will register with INTIME after September 3, along with introducing the new electronic Power of Attorney process and outlining how customers can get their INTIME-specific questions answered. Check in with ProjectNextDOR.dor.in.gov at any time for more information!

|